Standard Tax Deduction 2025 – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2025, which could result in a lower tax bill for many Americans. . Stay updated on the standard deduction amounts for 2025, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Standard Tax Deduction 2025

Source : www.forbes.comStandard Deduction 2025 Amounts Are Here | Kiplinger

Source : www.kiplinger.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax brackets 2025| Planning for tax cuts | Fidelity

Source : www.fidelity.comIRS Announces 2025 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comProjected 2025 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS raises tax brackets, see new standard deductions for 2025

Source : www.usatoday.comYour First Look At 2025 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS Releases Tax Brackets and Other Key Limits for 2025 Cerini

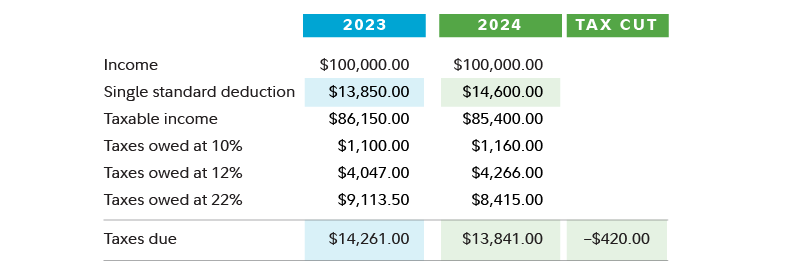

Source : ceriniandassociates.comStandard Tax Deduction 2025 Your First Look At 2025 Tax Rates: Projected Brackets, Standard : Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . For a married joint filer, the standard deduction would be increased by $3,250 to $27,650. For a head of household filer, it would be increased by $2,450 to $20,800. .